Monthly Processing Statement Fees Explained (And Why Most Are Predatory) Shark Processing, Zen Payments, Revolve, and High Wire Payments: Which One Is The Best?

Ever look at your merchant processing statement and think: what is all this stuff? From IRS fees to PCI penalties and “monitoring” fees, some processors make a killing on line items you barely understand. Here’s a full breakdown of what those charges really mean and how High Wire Payments does it better with flat, honest pricing.

Table of Contents

This should be a basic admin fee — but often acts as a cover charge before more junk gets tacked on. High Wire Payments keeps it simple: one flat $25 monthly fee, all-in.

This should be a basic admin fee — but often acts as a cover charge before more junk gets tacked on. High Wire Payments keeps it simple: one flat $25 monthly fee, all-in.

If you’re not certified as PCI-compliant, many providers charge $25/month penalties. Even if you are compliant, they may charge $5.95–$15/month for their “PCI Program.” Either way, it’s a cash grab.

For CBD and other high-risk industries, some processors tack on “monitoring” fees (like $50/month) just for labeling your business type. High Wire Payments charges zero industry-specific junk fees.

This $15/month fee claims to verify your website for compliance. In practice, it’s usually automated — and unnecessary. High Wire Payments doesn’t charge it, period.

Yes, they really charge $10–$20/month just to access your own statements. High Wire Payments provides full access without extra charges.

AVS (Address Verification Service) helps fight fraud — useful, yes — but often monetized as a per-transaction charge. AVS fees happen per each transaction and can quickly add up. Make sure your AVS fee is under $0.15.

Fee Comparison + Proof

Below are direct screenshots from competitors like Revolve, Zen Payments, and Shark Processing — showing just how many hidden fees can stack up.

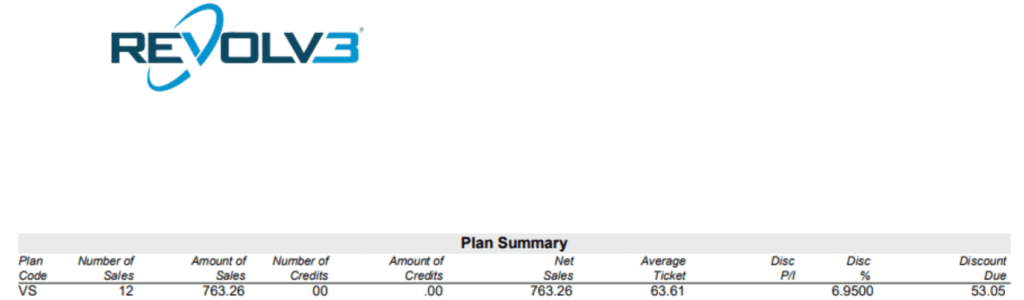

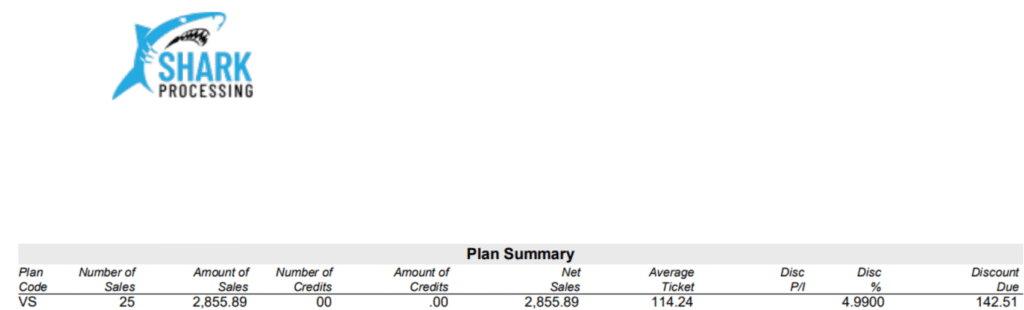

How to find the processing rate:

On each statement, scroll to the “Plan Summary” section. Look for the line labeled Disc %. The number after that is the actual processing rate being charged.

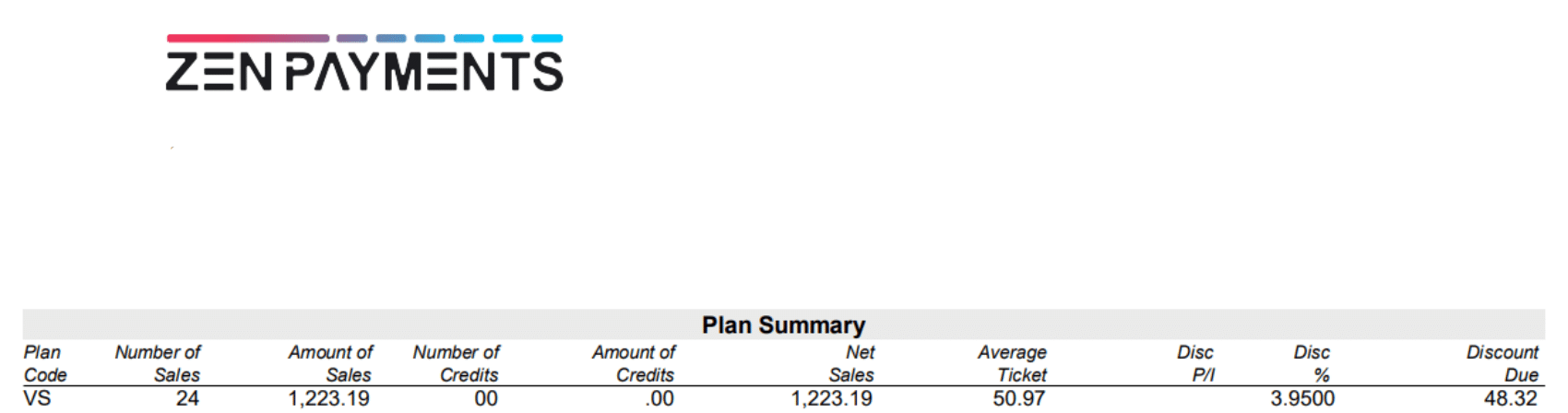

Zen Payments Statement — Monthly Fees

Zen Payments Statement — Processing Rate

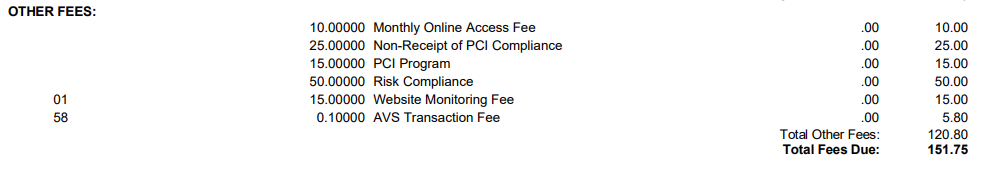

Revolve Statement — Monthly Fees

Revolve Statement — Processing Rate

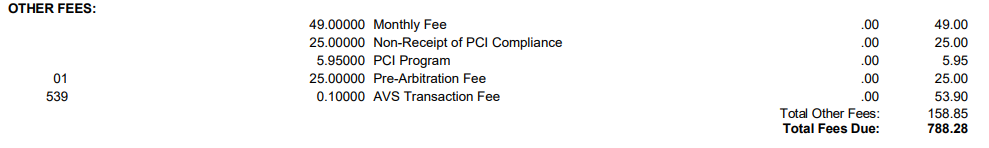

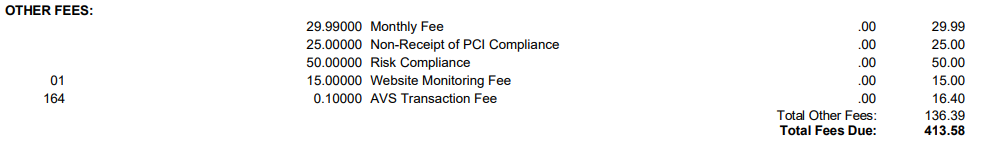

Shark Processing — Monthly Fees

Shark Processing — Processing Rate

Processor Fee Comparison

| Feature | Shark | Zen | Revolve | High Wire |

|---|---|---|---|---|

| Processing Rate | 4.99% + $0.15 | 3.95% + $0.15 | 6.95% + $0.15 | 1.50% + $0.10 |

| Monthly Fee | $49.00 | $125.00 | $115.00 | $25.00 |

| PCI Program | $5.95 | $5.95 | $15.00 | Included |

| Website Monitoring | $15.00 | $0.00 | $15.00 | Included |

| CBD Monitoring | $50.00 | $50.00 | $50.00 | Included |

| AVS Fee | $0.10 | $0.10 | $0.10 | Included |

| Non-PCI Compliance Fee | $25.00 | $25.00 | $25.00 | $25.00 |

| Risk Compliance | $50.00 | $0.00 | $50.00 | $0.00 |

Frequently Asked Questions

Standard processors avoid industries like CBD, credit repair, kratom, and more. Leah with High Wire Payments specializes in getting you approved even when others won’t.

These platforms suspend high-risk accounts without warning. Using them puts your income and business at risk.

Typically 24–72 hours with complete documentation.

No. We don’t penalize your business with unnecessary compliance fees. We’ll guide you through certification if needed.

Do you offer custom pricing?

Meet Leah at High Wire Payments

Leah Walczuk is a payment processing expert in the high-risk space, working as a direct account agent. She helps businesses with customized solutions to get approved fast, save on fees, and thrive without the usual headaches of high-risk processing. She is the direct point of contact for all of her high-risk merchants, available 24/7.

(805) 849-4799 | leah.walczuk@highwirepayments.com

515 Marin St, Thousand Oaks, CA 91320

High Wire Payments | highwirepayments.com

Industries

Kratom

CBD & Flower

Hemp & Cannabis Seeds

Delta-8, Delta-9, THCA

High Wire Enterprises, LLC | highwirepayments.com

Yes! We tailor rates based on your monthly volume and risk profile — all transparent, no contracts.